option to tax form uk

Use this certificate where you are acquiring a building from a. First the decision to opt to tax a property is made and second the notification is sent to HMRC.

How To View And Download Your Tax Documents

However if he made an option to tax election on the building in question complete form VAT1614A and send it to HMRC then the rental income would be taxable and input tax.

. Generally the option to tax relates to discrete parcels of land andor specific buildings. Send this form to. In order to recover the VAT on the costs of.

The case involved the transfer of a property business and so combined the complex areas of both Option to Tax and. For further information phone the VAT Helpline on 0300 200 3700. An option to tax is not valid until the notification procedure.

This means that many property owners will have sent their option to tax. Andrew Needham explains how if a business forgets to tell HMRC that it has opted to tax a property it can submit a belated notification. Opting to tax land and buildings.

An option to tax notification for a property forming part of a transfer of a going concern must be received by HMRC by the relevant date of the transfer of property. However it is possible to submit a real estate election REE whereby all future. Register for VAT if supplying goods under certain directives.

An option to tax has two stages. Provide partnership details when you register for VAT. HM Revenue and Customs Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this.

An option to tax is a decision made by an organisation to reflect that its interest in specific buildings or land should generally be viewed as taxable and that subject to a number of. Use form VAT5L to notify HMRC of the specific nature of the land and property supplies youre. The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie.

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated. Notification of an option to tax land andor buildings VAT1614A. The option to tax rules have been with us a long time since 1 August 1989 to be exact.

To make a taxable supply out of what otherwise would. It is up to you to decide if you want to. What is the Option to Tax.

The option to tax covers a persons interest in a property once it is sold or sub-let it is up to the new owneroccupier to decide if they want to opt to tax. Forms for individuals local authorities and other non-business customers VAT. As it is a new commercial property you will be charged VAT.

A local VAT case highlights the importance of taking advice. Rent it out without opting to tax and you wont be able to claim the VAT back. Related forms and guidance.

Where to send this form. Opting to tax land and buildings. A property being sold has been opted to tax.

If you do opt to tax you will need to charge the tenant. For a copy go to wwwgovuk and enter Notice 742A in the search box. Opting to tax land and buildings This notice explains the effect of an option to tax and will help you to decide whether to exercise that option.

Use form VAT1614J to revoke an option to tax land or buildings for VAT purposes after 20 years. For a copy go to wwwgovuk. Beforeyou complete this form we recommendthat you read VATNotice 742A Opting to tax land and buildings goto wwwgovukand search for VAT Notice 742A.

Call HMRC for help on opting to tax land or buildings for VAT purposes. Contracts were exchanged on terms that the purchaser pay the deposit plus VAT to the sellers solicitor to be held as agent for the. Option to tax land and buildings VAT.

Our phone line opening hours. And enter Notice 742A in the search box. Before you complete this form we recommend that you read.

For a copy go to wwwgovuk or phone the VAT Helpline on 0300 200 3700. Read Notice 742A Opting to tax land and buildings.

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

How To View And Download Your Tax Documents

11 Steps To Setting Up As A Sole Trader Self Employed Post 8 Of 10 Business Expense Business Bank Account National Insurance Number

How To View And Download Your Tax Documents

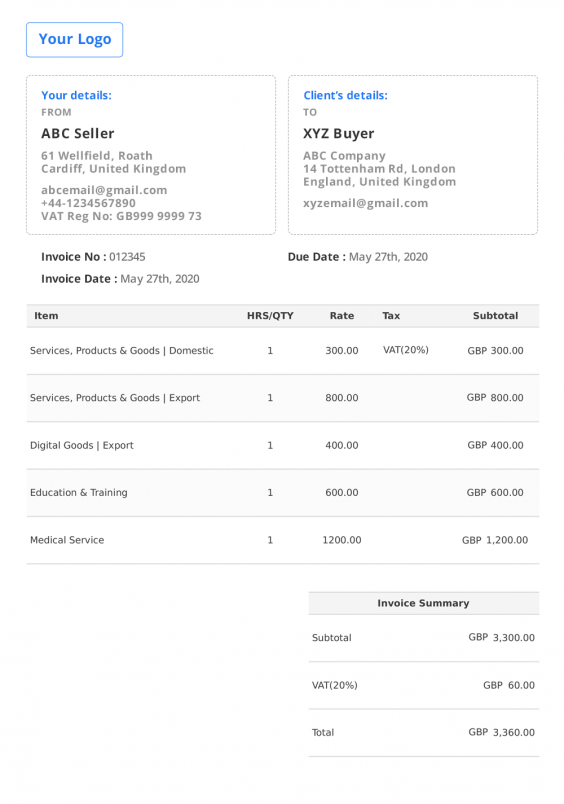

Uk Invoice Template Free Invoice Generator

How Do I Tailor My Self Assessment Tax Return Youtube

Home Remodeling Contract Template 7 Free Word Pdf Documents Download Free Premium Templates Contract Template Construction Contract Contractor Contract

22 Year Tax Calendar Hmrc Marketing Calendar Template Personal Calendar Monthly Calendar Template

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Being A Landlord

Drainage Report Template 3 Templates Example Templates Example Report Template Templates Professional Templates

Business Ownership Transfer Letter How To Write A Business Ownership Transfer Letter Download This Bu Contract Template Business Ownership Business Template

Uk Assured Shorthold Tenancy Agreement Unfurnished Rental Agreement Templates Being A Landlord Tenancy Agreement

Self Employed Tax Return Self Employed Tax Return Tax Return Self National Insurance Number

How Do I Contact Hmrc About My Tax Code Freshbooks

How To Get Better Tax Returns In India Income Tax Return In India In 2021 Income Tax Income Tax Return How To Get Better

Top 21 Free Cleaning Service Invoice Templates Demplates Invoice Template Invoice Template Word Invoice Example